Payroll FAQ

If you need professional help with complying with the Employment Act, Employee's Provident Fund (EPF), SOCSO, Employment Insurance System (EIS), Human Resources Development Corporation (HRDCorp), Potongan Cukai Bulanan (PCB) and IRB related forms, please contact us or get a quote from our friendly team of payroll advisors.

Malaysian Employment Law for Companies and Entrepreneurs; Employees covered under Employment (Amendment) Act 2022

Since your company is new and you have hired an employee, you will need to register your company with Kumpulan Wang Simpanan Kerja (KWSP), Pertubuhan Keselamatan Sosial (PERKESO) and also inform Jabatan Tenaga Kerja (also known as Labour Office) about your new company, as well as inform Inland Revenue Board (IRB) on the new staff hired. For a company that is subjected to pay HRDCorp, you will also need to register with the Human Resources Development Corporation (HRDCorp).

Under Section 60A(1), normal working hours are as follow:

- 8 hours a day, not including a period of rest of at least 30 consecutive minutes;

- for more than 5 consecutive hours of work, there must be a period of rest of not less than 30 minutes (if any of the break is less than 30 minutes, it will not be considered as a break);

- Combining normal working hours and breaks together must not exceed 10 consecutive hours in a day;

- not more than 45 hours in a week.

The minimum working age is 13 years old. Between the ages of 13 and 16, only light work can be involved. Please refer to the Children and Young Persons (Employment) (Amendment) Act 2019 for further understanding.

Under the law, overtime payment is required to be paid to employee after normal working hours. The rate of payment after normal working hours on work day is at 1.5 times ORP (ordinary rate of pay). Besides, overtime payment is also required to be paid for work on a rest day or a public holiday, but each at a different rate of pay.

Work on Rest Day |

| Half the ORP | For work exceeding half of the normal hours of work |

| 1 day’s ORP | For work exceeding half but does not exceed the normal hours of work |

| 2 times hourly rate of pay | For work exceeding one normal work day |

Work on Public Holiday |

| 2 day’s ORP | For work not exceeding one normal work day |

| 3 times hourly rate of pay | For work exceeding one normal work day |

The maximum working hours per day that can be required of an employee are 8 hours. With overtime, it can be increased to 12 hours.

No, you can’t. Under the law, every employee shall be allowed to take one whole day as rest day in each week.

An employee should be entitled to annual leave of not less than the followings:

| Less than 2 years of service | 8 days for each year of service |

| More than 2 years but less than 5 years | 12 days for each year of service |

| 5 years or more | 16 days for each year of service |

The minimum Public Holidays required to be granted to the employees are 11 paid public holidays in a calendar year.

Out of the 11 paid public holidays, there are 5 mandatory and non-substitutable holidays: National Day, Malaysia Day, Birthday of the King, State Ruler’s Birthday or Federal Territory Day and Workers’ Day.

An employee should be entitled to sick leave of not less than the followings:

| Less than 2 years of service | 14 days in each calendar year |

| More than 2 years but less than 5 years | 18 days in each calendar year |

| 5 years or more | 22 days for each year of service |

The retirement age is 60 years old.

EPF

EPF is a compulsory savings plan and retirement benefits for workers in Malaysia.

Yes, you do. As an employer, the persons that you should contribute EPF are as follows:

- Employees who are paid salary/wage

- Directors who receive salary/wage

- Part-time and temporary employees and employees on probation who are paid salary/wage

- Employees are to contribute until the age of 75 years old if they are still working regardless whether they have or have not made the full withdrawal/part of it after attaining the age of 55 years old

- Employees who are 55 years and above and have never been a member of the EPF

- Employees who have previously made full withdrawal under the Incapacitation withdrawal and have since recovered and are re-employed in any service.

Socso and EIS

Socso provides protection to workers who may have been involved in an accident at work or contracted an illness as a direct result of work.

An employee is any person who is employed for wages under a contract of service or apprenticeship with an employer, whether the contract is expressed or implied or is oral or in writing, or in connection with the work of an industry to which the Act applies.

For employees who work in the private sector that earns less than RM4,000 per month. However, for employees who earn more than RM4,000 per month; if they have previously registered, they will be required to continue contributing. An employee must be registered with Socso regardless of their age. The principle is “once in, always in”.

EIS is a system that aims to help workers who have lost their jobs, providing temporary financial assistance and employment services.

Yes. EIS contribution is mandatory for employees aged 18 to 57 years old.

HRDCorp

HRDCorp is a pool of funds that are contributed by the employer on a monthly basis for the purpose of employee training and skills upgrade.

Effective from 1st March 2021, with the amendment on the HRDF Law, the scope of coverage of the Pembangunan Sumber Manusia Berhad Act 2001 now requires ALL industries to register and contribute to HRDCorp , EXCEPT for:

- Federal and State Government

- NGOs involved in Social Welfare Activities

Among some of the newly added sectors under HRDCorp, include the following:

- Construction sector;

- Trading, Retail and Wholesale sector, eg. Mini Market, Convenience Store, etc;

- Culture, Arts and Entertainment sector;

- Professional sector, eg, Lawyer, Designer, etc;

- Administration and Support Service sector, eg, Renting and Leasing of Vehicles, Renting of Equipment, etc;

- Education sector, eg, Tuition Centre, Sports Teaching, Recreation Education, etc;

- For the full list of newly covered sectors, please refer to P.U.(A) (85) http://www.federalgazette.agc.gov.my/outputp/pua_20210226_PUA85_2021.pdf

The HRDCorp contribution is treat as an expenses for the company and to be paid by the employer without deducting the employee’s salary.

HRDCorp monthly payment must be made before 15th of the subsequent month.

- Company with 10 or more local employees: MANDATORY registration with rate of levy payment of 1% of total employees’ gross salary(*)

- Company with 5-9 local employees: Voluntary registration with 0.5% of total employees’ gross salary(*)

- Company with less than 5 local employees can be exempted

*Gross salary include Basic salary and Fixed Allowance.

| Eligibility Criteria | Rate Of Levy Payment |

| ≥ 10 Malaysian Employees (mandatory to register) | 1% |

| 5 - 9 Malaysian Employees (given option to register) | 0.5% |

You may engage us for the services. For further enquiries, please feel free to call our customer careline or email to us.

PCB and IRB related Forms

PCB is a series of monthly tax deductions that go towards payment of the employee taxes in relation to their employment income. These monthly deductions are retained by the employer and paid to the Inland Revenue Board (LHDN).

Borang CP22 is a form that needs to be filled by the employer to notify the Inland Revenue Board (LHDN) each time he or she hires a new staff within 30 days after commencement of the employment of the new employees.

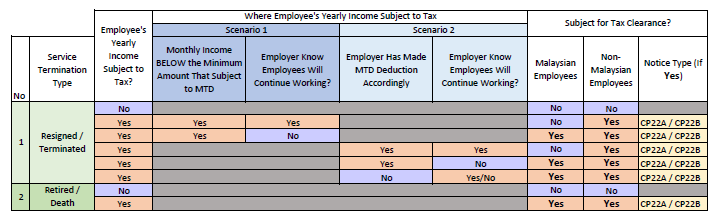

Borang CP22A is a form that needs to be filled by the employer of a Private Sector to the Inland Revenue Board (LHDN) upon the cessation of his employee 30 days before the employee leaves the company. Kindly refer to IRB guidelines on under what situation an employer needs to submit CP22A to IRB.

Starting from 1 January 2024, a Sdn. Bhd. company is compulsory to submit Form CP22 and CP22A to Inland Revenue Board (LHDN) online via MyTax Portal. However, for a non Sdn. Bhd. company, Form CP22 and CP22A can still be submitted over the counter (to IRB) until further notice.

CP22 and CP22A have need to be submitted on time. Failure to comply with the above provisions, employers will be liable to the following penalties: (i) a fine of not less than RM200 and not more than RM20,000 per form; or (ii) imprisonment for a term not exceeding 6 months; or (iii) both.

Probationary

The term probation period is not specified in the Employment Act 1955 or in the Industrial Relations Act 1967.

A probation period is a “trial” period that a probationer (a new employee) needs to go through to prove his/her fitness for the position which was offered by the employer. There is no legal requirement to put an employee under probation before they are hired, it is just best practice. As a result, there is also no “minimum” or “maximum” probationary period, usually the common practice is between 3 to 6 months.

No. For employees under probation, you will still need to contribute their EPF, Socso and EIS.

Yes, the period under probation is also included when calculating annual leave entitlement.

Due dates and contributions

As an employer, you will need to contribute EPF, Socso, EIS, PCB and HRDF (if any).

The monthly contribution has to be made on or before the 15th of the following month.